Disability and Life

Benefits that provide income and financial protection if you are unable to work or in the event of death.

Your Options

If You Have an EIB Balance

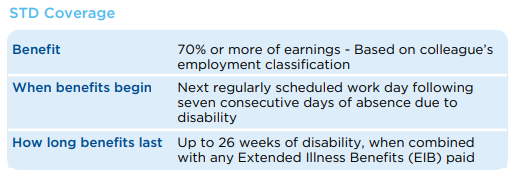

Your Extended Illness Benefit hours will be available for you to use for sickness or illness. Like STD, EIB begins on the next regularly scheduled work day following seven consecutive calendar days of absence due to disability. The STD benefit is payable after you exhaust any accrued EIB balance. Once your EIB hours are used, the STD program will provide a continuous benefit of 70% of your base pay for the rest of your first 26 weeks of disability.

STD and PTO

Paid Time Off (PTO) will be used to receive pay for any regularly scheduled work days that fall within the first seven consecutive calendar days of absence when STD benefits are not payable. You may also use PTO to supplement your pay while receiving STD benefits. The combination of PTO and STD payments cannot exceed 100% of your regular pay.

STD/Family Medical Leave Forms

Request for Use of Paid Time Off (PTO) with Short-Term Disability

Request to Reserve Paid Time Off (PTO) with Family Medical Leave

General Leave of Absence Application Form

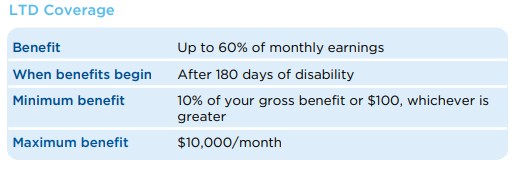

LTD benefit payments are taxable when received.

Definition of Disability

You are considered to be disabled if you:

- Cannot perform the main duties of your regular occupation due to your illness or injury; and

- Have a loss of 20% or more of your earnings due to that illness or injury.

After benefits have been paid for 24 months, you are considered disabled if you cannot perform the key duties of any gainful occupation for which you are reasonably qualified by training, education, or experience. Department directors and above and physicians have “own occupation” definition for duration of disability. You must be under the regular care of a physician to be considered disabled. You must be under the regular care of a physician to be considered disabled.

About Your LTD Benefits

LTD benefits may be reduced by any benefits you receive from other sources, such as:

- Worker's Compensation, state-mandated disability benefits, third-party reimbursements, unemployment and other employer wages.

- Disability benefits for which you, spouse or children are eligible because of your disability under Social Security, Railroad Retirement or any similar governmental plan.

For example, if the combination of your HSHS-funded LTD benefits and benefits from other sources is less than 60% of your pay, you would receive an HSHS benefit that would bring your total benefit from all sources up to 60%.

If you are collecting LTD benefits and can do some work, even if you continue to meet the plan's definition of disability, you may be eligible for partial disability benefits; see the Disability SPD for more information.

How Long LTD Benefits

- If you are disabled before age 60, you are eligible to receive LTD benefits until you are no longer disabled or to age 65, whichever is earlier.

- If you are disabled between age 60 and 69, benefits continue for a specific number of months, as long as you continue to be disabled.

- Benefits for a disability due to substance abuse or mental or nervous disorders are payable for up to 24 months.

LTD Plan Exclusions

Benefits are not provided for disabilities due to:

- Intentionally self-inflicted injuries

- Active participation in a riot

- Loss of professional license, occupational license or certification

- Commission of a crime for which you have been convicted

- War, declared or undeclared, or any act of war

- Any period of disability during which you are incarcerated

- Pre-existing conditions (see Disability SPD for definition)

See the Long-Term Disability SPD for more information.

HSHS provides basic life insurance and accidental death and dismemberment (AD&D) coverage at no cost to you.

Basic Life and AD&D Coverage

You automatically receive basic coverage of 1.5x your annual salary, to a maximum of $50,000. Your annual salary is based on your rate of pay and regularly scheduled hours as of October 1st of the previous year.

Basic AD&D coverage amounts are paid in the event of accidental loss of life; both hands or feet; sight in both eyes; one hand and one foot; and one hand or one foot and loss of sight in an eye, or loss of your speech and hearing. Half of the full coverage amount will be paid if you suffer a loss of one hand, one foot or sight in an eye, or loss of your speech or your hearing.

You are not required to provide evidence of insurability – or proof of good health – for basic life and AD&D coverage.

Need help determining the right coverage for you and your family? Access Benefit Scout, an online decision support tool that will help you decide what insurance options make sense for you and your family.

Living Care Benefit

If you buy additional term life coverage, the living care benefit is available to provide financial assistance if you become terminally ill by letting you receive a part of your life insurance benefit while you are living.

Colleagues can receive up to 100% of their basic life insurance amount during the 24 months prior to the expected date of death. Unlike life insurance benefits, living care benefits may be subject to taxes, so you are encouraged to consult a tax advisor before applying for this benefit.

Voluntary Accidental Death & Dismemberment (AD&D) Coverage

In addition to the basic AD&D insurance coverage provided by HSHS, you can purchase more coverage separate from life insurance for you and for your family through Securian. Your cost for voluntary AD&D coverage is paid on a pre-tax basis.

You may purchase coverage just for yourself, or for you and your family. You select one of the coverage amounts for yourself; that benefit is paid in the event of your accidental loss of life, and all or part of it is paid if you suffer loss of limb, sight, speech or hearing as a result of an accident, depending on the extent of your loss.

If you select family coverage:

- Your covered dependents have coverage amounts based on your coverage amount.

- Dependent benefits for accidental loss of life are based on your covered family at the time of an accidental loss.

- You and spouse only: your legal spouse is covered for 60% of your coverage amount.

- You, spouse and children: your legal spouse is covered for 50% of your coverage amount and each child is covered for 15% of your coverage amount.

- You and children only: Each child is covered for 20% of your coverage amount.

- For losses other than accidental loss of life, the Voluntary AD&D benefit will be based on the coverage you elect, the make up of your family (if you elect family coverage), and the type of accidental loss. See the Voluntary AD&D SPD for more details.

Other plan features include: seatbelt and airbag benefit, education benefit (when family coverage is elected), occupational HIV or hepatitis benefit (for you only), child care benefit, increased child dismemberment benefit, psychological therapy benefit and rehabilitation benefit.

For more information, see the Voluntary AD&D SPD.

Supplemental Life – Securian

In addition to the basic life insurance, you can purchase supplemental life insurance for you and your eligible dependents through Securian. Your options include:

- Supplemental life insurance for you from one to eight times your pay, up to $1,000,000 in additional coverage.

- Supplemental life insurance for your legal spouse in $5,000 increments from $5,000 to $100,000. The amount of life insurance coverage you elect for your spouse cannot exceed the total amount of your life insurance coverage (basic and supplemental combined). If your spouse is eligible for supplemental life insurance as an employee, you cannot elect spousal coverage. Your spouse must enroll in supplemental life insurance as an employee.

- Supplemental life insurance for your eligible dependent children in the amount of $20,000. When you select supplemental children’s life insurance, each child from live birth is covered for the same amount.

You pay for supplemental life insurance with after-tax payroll deductions. Premiums for your coverage are age-based and differ for smokers and non-smokers. Spouse premiums are also age-rated. Click HERE to review your monthly cost of coverage.

For children, the supplemental life insurance premiums are a flat amount - regardless of the number of children. The premiums for coverage are as follows:

Addition Lifestyle Benefits

Access additional resources through the Lifestlye Benefits program to help protect your financial wellness. Additional resources include:- Legal, financial and grief resources

- Travel assistance

- Legacy planning resources

- Beneficiary financial coaching