Cardiovascular disease remains the number one cause of death in the United States and world. When Dr. James Dove established Prairie Cardiovascular in 1979, his vision was to extend access to world-class care throughout rural Illinois.

The result is a network of community cardiovascular clinics that has grown to include more than 100 cardiologists and advanced practice clinicians who care for patients in 40+ clinic locations throughout central and southern Illinois.

Prior to his death in 2010, Dr. Dove often reminded colleagues, “The past provides us with direction, and the future provides us with opportunity.”

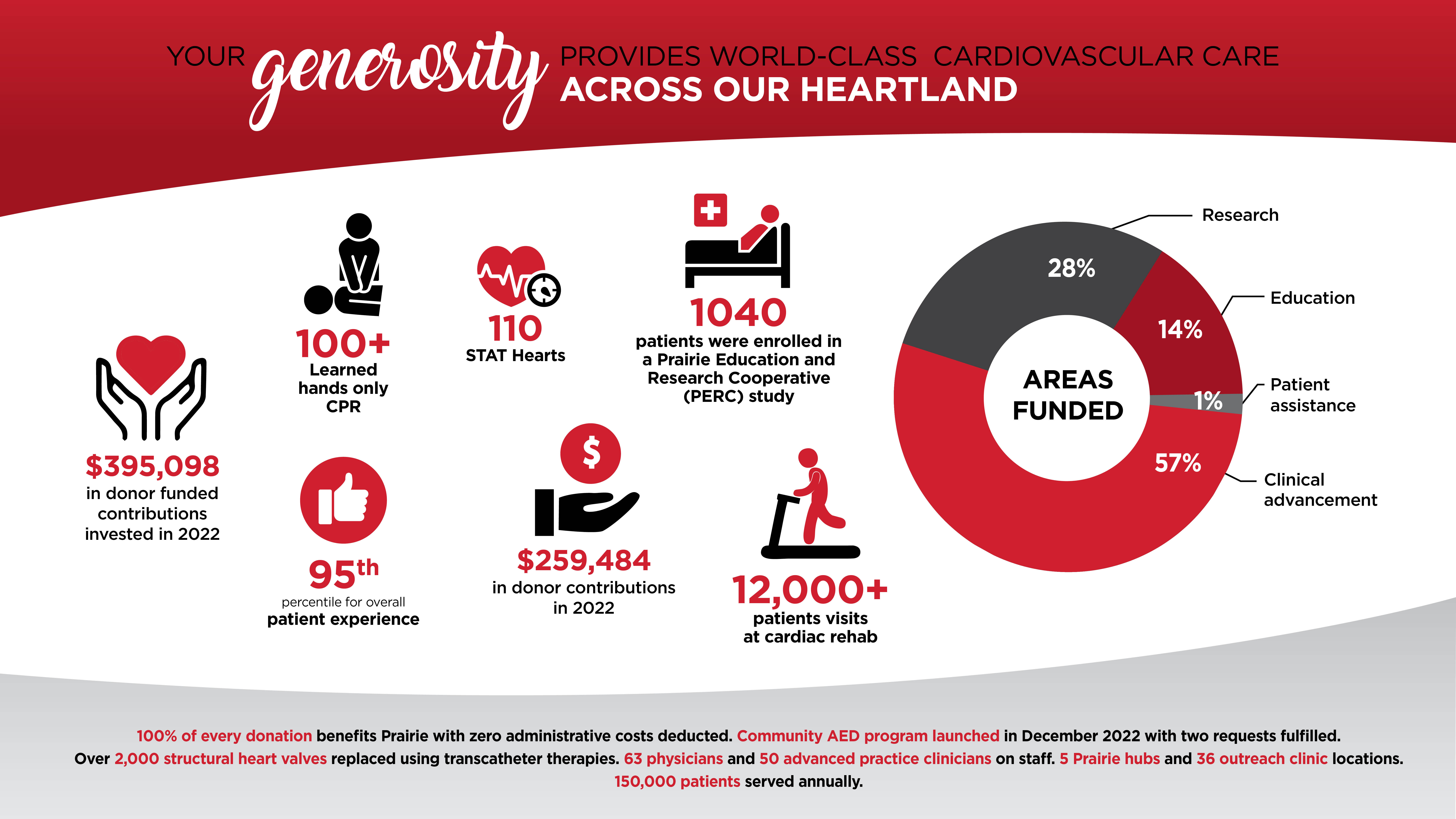

With your gift to the Prairie Heart Foundation, you can directly support innovative technology, expanded access to patient care, research, patient and operating rooms, medical education, equipment, and where the need is the greatest. You may also pay tribute to a special person who made a difference in your visit or stay with us. Your caregiver will receive an acknowledgment letter announcing a contribution has been made in his or her honor.

Thank you for your generosity that allows us to continue our shared mission to deliver nationally recognized care in local communities, as well as developing new and more efficient ways of meeting our patients’ needs.